The way clients choose an accountant has changed dramatically in the last few years. Today, the first step in most client journeys happens online, not across a desk or through a referral. Search engines, maps, and online content now shape trust before a call is ever made.

Almost 89.6% of all online journeys start on Google. If you are not visible on the search results of Google, you are absent from the conversation clients are already having. At Comval, we often meet firms with years of experience, highly qualified accountants, and a portfolio of satisfied clients. Yet, despite their expertise, enquiries stay low. The issue is rarely competence. It is visibility. In today’s world, the first meeting does not happen across a desk. It happens online.

How Clients Actually Search Today

We track behaviour across projects to understand how potential clients make their choices. Again and again, the same patterns appear. The numbers confirm that search habits now decide which firms win attention and which ones go unnoticed:

-

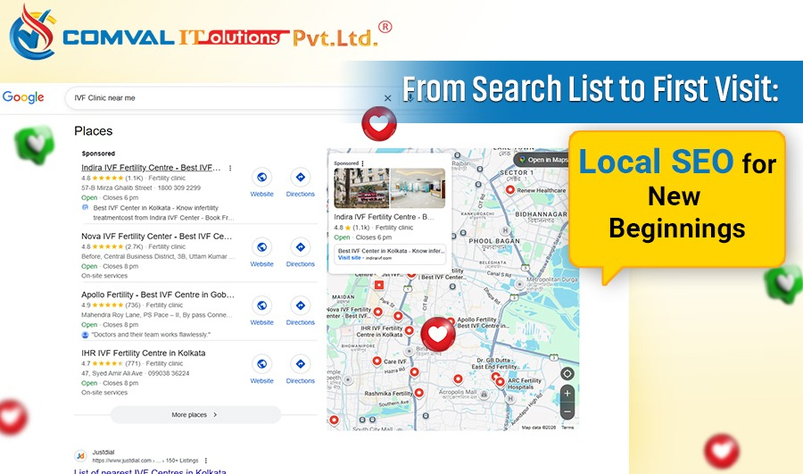

Maps as a Gateway: Around 86% of users check Google Maps before visiting a business. For finance firms, this makes a complete profile essential. Without accurate details, reviews, and photos, trust is weakened before contact even begins.

-

Quick Decisions: About 67% of service-related searches lead to an offline meeting or call within 48 hours. That means appearing in search is not just visibility, it is opportunity that converts rapidly into real conversations.

-

Mobile First: Google accounts for 79.1% of desktop searches but rises to 93.8% on mobile. Clients increasingly search on their phones, and a finance site that is not mobile-ready risks losing the majority of potential leads.

-

Ease of Access: 81% of users say finding professional service information online is easy. Firms that do not provide clear, structured, and trustworthy content fail to meet this expectation, which can cost them enquiries.

-

Alternatives Emerging: AI-powered and privacy-focused engines are gaining traction, but together they remain only a small fraction compared to Google’s dominance. They signal change, yet Google continues to shape most client journeys.

Old vs New Client Journey

| Yesterday’s Path | Today’s Path |

|---|---|

| Ask a colleague for a referral | Type “tax advisor near me” on Google |

| Walk into an office unannounced | Read reviews and check Google Maps |

| Decide after a networking lunch | Decide after reading online content |

| Rely on introductions | Rely on digital credibility |

| Judge expertise by office size | Judge expertise by website content |

| Wait for annual seminars | Follow regular updates shared online |

| Reputation spread by word of mouth | Trust verified by ratings and search visibility |

Visibility Enhancing Authority

SEO for accounting firms is not a trick or a shortcut. It is the digital equivalent of reputation, shaping how potential clients perceive you before they ever pick up the phone. A strong presence tells clients that you are established, reliable, and prepared to handle their needs.

As an accounting marketing agency, we focus on three pillars:

-

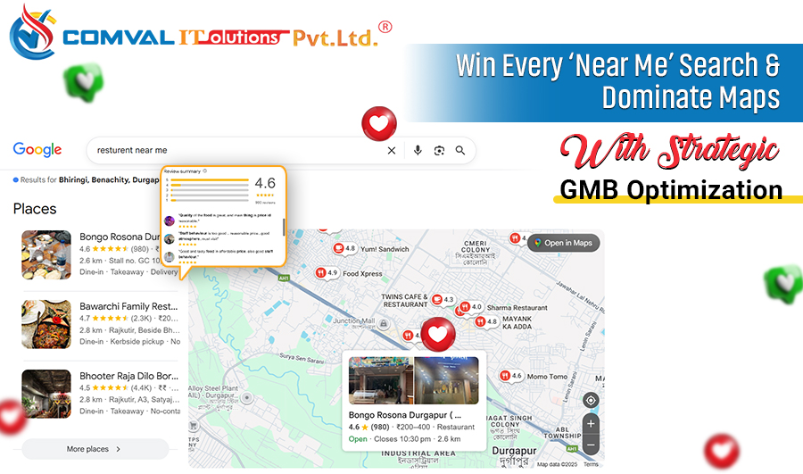

Search Presence: Appear for searches like “SEO CPA” or “financial reporting consultant.” Ranking in these results ensures your firm is visible at the moment intent is strongest.

-

Trust Signals: Reviews, complete Google Business Profiles, and accurate information act as proof of credibility. They reassure clients that your firm is not only active but also recommended by others.

-

User Experience: Accounting website design that is quick, mobile-ready, and simple to navigate makes the firm approachable. When a site is seamless, it reflects the professionalism of the practice itself.

When blended together, these elements create a foundation of credibility long before the first handshake. This makes your expertise visible and trustworthy in the eyes of decision-makers.

Content That Extends Expertise

Our work as a financial advisor marketing agency shows that clients rely heavily on online content. They do not simply want advertisements or generic statements. They want answers that solve real problems and guidance that reflects practical experience. The goal is not endless volume but relevance, clarity, and authority.

-

Regulatory Updates: Short explainers on tax or audit changes show awareness of evolving requirements. They help potential clients feel confident that your firm keeps pace with shifting rules.

-

Guides for Businesses: Practical content helps SMEs and entrepreneurs solve urgent challenges, such as preparing for year-end reporting or navigating VAT. These guides demonstrate empathy as well as expertise.

-

Thought Leadership: Insights on compliance, risk management, and structuring demonstrate depth of understanding. They position your firm as more than a service provider, but as a trusted advisor with foresight.

This type of financial marketing service transforms expertise into visible proof. It is not marketing fluff or empty promotion. It is knowledge shared openly, in a way that clients can understand and trust.

The Comval Perspective

We have seen how visibility changes outcomes. One firm we worked with had the expertise but struggled with enquiries. After publishing expert guides and optimising its profile, their enquiry rate doubled within months. The skills had always been there, but discoverability made the difference.

At Comval, we believe accountants should be chosen for their knowledge, not overlooked because they stayed hidden. But if that’s the current trend, we should employ strategies that don’t let you stay hidden from sight.

Our role as a financial and healthcare digital marketing agency is to make that expertise visible in the spaces clients already trust. Clients are searching now, and the only question is whether they will find you or someone else.

You can connect with our experts today or request a free quote to explore how we can strengthen your digital presence. Let’s position your firm where the client’s journey begins.